take home pay calculator maryland

If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. The table below provides an example of how the salary deductions look on a 9000000 salary in 2022.

Wondering How Long It Will Take You To Pay Off Your Mortgage Use This Free Heloc Calculator To See What It Will Tak Heloc Mortgage Payment Calculator Mortgage

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Maryland. When you make a pre-tax contribution to your retirement savings account you add the amount of the contribution to your account but your take home pay is reduced by less than the amount of your contribution. Please follow the directions on the Central Payroll web page to estimate your take home pay.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. It should not be relied upon to. Calculate your Maryland net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Maryland paycheck calculator.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

Each key component that affect income tax calculations Medicare Calculation and Social Security Calculations is detailed. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Maryland. The Maryland Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Maryland State Income Tax Rates and Thresholds in 2022.

The State of Maryland Central Payroll Bureau has designed a net pay calculator to help state employees estimate their taxes and net pay. Net Pay Calculator Selection The net pay calculator can be used for estimating taxes and net pay. Overview of Federal Taxes.

For visual explanations of the above steps you can refer to Youtube videos from Ladder Up MoneyCoach or Edspira. Take Home Pay Calculator Maryland. To use the tax calculator enter your annual salary or the one you would like in the salary box above.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Thats the five steps to go through to work your paycheck. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This Maryland hourly paycheck calculator is perfect for those who are paid on an hourly basis. Determine taxable income by deducting any pre-tax contributions to benefits.

For a married couple with an annual wage of 160000 in Baltimore City the total take home pay after taxes is 12062877. This is only an approximationBe aware that deduction changes or deductions not taken in a particular pay will have an impact on your net pay. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

Maryland Salary Calculation - Single in 2022 Tax Year. If you earn 20500000 or earn close to it and live in Maryland then this will give you a rough idea of how much you will be paying in taxes on an annual basis. Payroll Schedules Salary Scales Forms Contact Information.

Maryland Salary Paycheck Calculator. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52 52000.

You need to do these steps separately for federal state and local income taxes. Due to changes to the Federal W-4 form in 2020. It can also be used to help fill steps 3 and 4 of a W-4 form.

Although our salary paycheck calculator does much of the heavy lifting it may be helpful to take a closer look at a few of the calculations that are essential to payroll. Salary paycheck calculator guide. Total annual income Tax liability All deductions Withholdings Your annual paycheck.

This net pay calculator can be used for estimating taxes and net pay. You are able to use our Maryland State Tax Calculator to calculate your total tax costs in the tax year 202122. Find out the benefit of that overtime.

How to calculate net income. However an annual monthly weekly and daily breakdown of your tax amounts will be provided in the written breakdown. Calculating paychecks and need some help.

Home Maryland Taxes Marylands Money Comptroller of Maryland Media Services Online Services Search. 2022 Comptroller of. The various payroll deductions are then detailed based on different payment periods this is useful.

How do the number of allowances affect the federal tax withholdings. Supports hourly salary income and multiple pay frequencies. Important Note on the Hourly Paycheck Calculator.

Please answer the questions below so that you can be redirected to. This calculator is intended for use by US. For a married couple with an annual wage of 160000 in baltimore city the total take home pay after taxes is 12062877.

Switch to Maryland salary calculator. Net Pay Calculator with Updated W-4 This version of Net Pay Calculator should be used by those who submitted Federal W-4 in 2020 or later. How to use the Take-Home Calculator.

Details of the personal income tax rates used in the 2022 Maryland State Calculator are published below the calculator this includes historical tax. This free easy to use payroll calculator will calculate your take home pay. The Maryland legislature in its 2002 session passed a bill that changed the amount to be exempted from the salary lien provision of the income tax law in order to conform with amounts for other wage liens listed in the Commercial Law Article Section 15-601-1.

Switch to Maryland hourly calculator. Salary Lien Provision for Unpaid Income Taxes. The taxes that are taken into account in the calculation consist of your Federal Tax Maryland State.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. For a single filer with an annual wage of 80000 in Baltimore City the total take home pay after taxes is 5980625. Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying but a.

Calculate The Total Time Cost And Interest Charges Of Getting Out Of Debt Using Minimum Payments For Paying Off Credit Cards Debt Calculator Credit Cards Debt

Cook County Il Property Tax Calculator Smartasset Retirement Calculator Property Tax Retirement Strategies

Maryland Paycheck Calculator Smartasset

Calculate Child Support Payments Child Support Calculator Proud Maryland Girl Child Support Laws Calculate Child Hoodies Sweatshirts Child Support Quotes

What Is Cap Rate And How To Calculate It Infographic What Is Cap Real Estate Infographic Investment Property For Sale

Who Pays The Highest Property Taxes Property Tax Real Estate Staging Denver Real Estate

Annapolis Bus Routes And Major Stops Color Coded Map Pdf Route Bus Route Map Bus Route

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Va Income Gu Mortgage Loan Originator Va Mortgage Loans Va Loan

Maryland Homecredit Program Lender Information

Maryland Paycheck Calculator Smartasset

Maryland Highway Lake Park Mountain Lake Empty Canvas

Buy A New Home In Maryland Local Social Media Social Media Consultant Social Media Expert

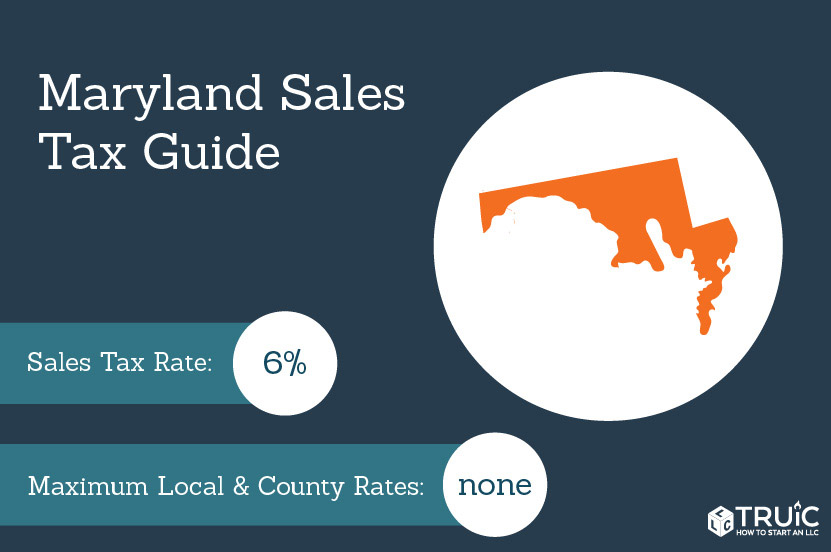

Maryland Sales Tax Guide And Calculator 2022 Taxjar

8309 Maryland Avenue Real Estate Outdoor Structures Property

Maryland Sales Tax Small Business Guide Truic

Should You Pay Discount Points Home Loans Mortgage Mortgage Interest Rates Lowest Mortgage Rates Mortgage Interest

A Call To Arms In The Maryland State Capital To Preserve Home Ownership Home Ownership Mortgage Interest State Capitals

A Full Guide To Buying A Home In The Dmv D C Maryland Virginia And Exactly How Long Each Step Takes Home Buying Buying First Home Buying Your First Home